Loan limits increased across the nation again in 2020. Here are the new California FHA and conforming loan limits for 1 unit properties by county: **2-4 unit properties have higher loan limits- contact us for those. County FHA Conv. Alameda 765,600 765,600 Alpine 463,450 510,400 Amador 355,350 510,400 Butte 331,760 510,400 Calaveras 373,750 510,400 Colusa […]

Building Long Term Wealth with Real Estate

The average rate of inflation over the past hundred years is 3.22%. It doesn’t seem like much, but at that rate prices double every 20 years! That means if you buy a property for $1 million, in 20 years is should be worth $2 million, in 40 years $4 million, and 60 years it should […]

Big Changes Coming For FHA Condo Purchases

FHA is making some big changes next month to their guidelines about approved condo HOAs. Around the middle of October 2019 they are going to start allowing “spot approvals” for condos that do not have FHA approved HOAs. This is huge for the condo purchase market! For almost a decade, if condos were not in […]

Equifax Was Told To Pay Up Over Breach- You Should Make Them Do It!

Remember the Equifax data breach announce in March of 2018? Maybe not, because it came just after the Target and Home Depot data breaches. In this case you might get something more out of it than aggravation, but only if you take about two minutes to submit a claim under the settlement Equifax just agreed […]

Program to Help Parents Who Want to Purchase a Home for Their Disabled Adult Child

There is a little know program offered Fannie Mae that allows parents of physically or developmentally disabled children to purchase a home for their adult child as an owner-occupied home. These parents will likely already own an owner-occupied home and the advantages of being able to purchase another home as owner occupied are twofold. The […]

Get $10,000 Toward Your Home Purchase in Orange County

Spring is in the air and home purchase season is heating up! We have a special offer to buyers in Orange County (and possibly other areas in CA). When you use our services to obtain your home loan (and remember- our rates beat all the big banks and credit unions), and allow us to refer […]

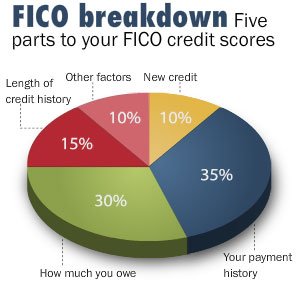

Credit Scores and How To Improve Yours

By Brian VerBurg #CreditScore #Mortgage #CreditReport #MyFico Having a great credit score will save you money on everything from credit cards, to car and home loans, and anything you want to finance. If you score is not in the 700’s or above you can likely get it there with just a little work and […]

Joke, Fun Fact, and Weekly Mortgage Tid Bit About: Investor Loans

By Brian VerBurg #MortgageTidBit #InvestmentProperty #RealEstate #RentalProperty #HomeLoans Knock! Knock! Who’s there? Candice. Candice Who? Candice door open, or am I stuck? Fun Fact: The Blue Whale is the largest animal to have EVER lived on earth, weighing up to 300,000 pounds. Their tongues alone can weigh as much as an elephant – their hearts, […]

Good News For Home Buyers- For The 1st Time In Five Quarters The Fed Didn’t Raise Interest Rates

By Brian VerBurg #homebuyer #interestrates #housingmarket Yippee!! The Fed didn’t raise rates again like they have for the past 5 quarters. The announcement was made after the Federal Reserve meeting this week. This is good news for home buyers, car buyers, and anyone looking to borrower money in the near future. The Fed has recently […]

1st Time Home Buyer Programs with 0 or little down

One of the biggest challenges for a 1st time home buyer is coming up with a down payment. Here are some popular loan programs that require 0 down, 3% down, or 3.5% down. CalHFA- This loan allows for 0 money down when you combine the CalFHA 1st and 2nd mortgage. The first is an FHA […]